Annual Income Tax Clinic

411 Seniors operates its Income Tax Clinic annually to assist low-income older adults and people with disabilities with the filing of their income tax returns. We can also file returns for past tax years! Please note that it is important to file income tax returns by April 30 in order to avoid interruption of certain benefits such as Guaranteed Income Supplement (GIS), Translink Bus Pass, etc. The filing of taxes will be by appointment only. To see if you are eligible to participate and for details on this year’s 2025 Income Tax Clinic, see below.

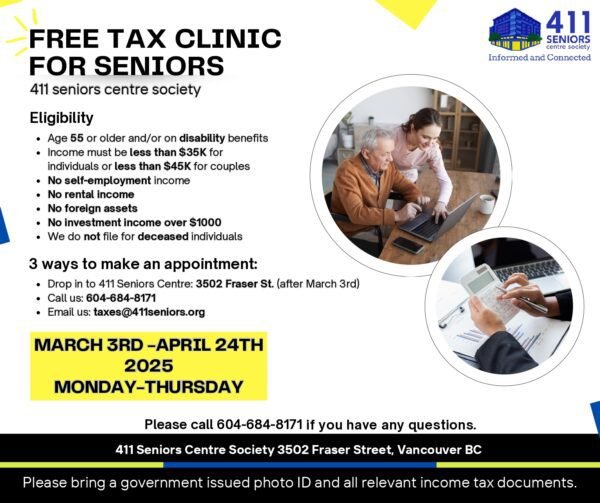

Eligibility for 411 Seniors’ Income Tax Clinic

- Older adults, aged 55 and older (and people with disabilities) who are single and earn less than $35,000 per year

- Older adult couple, aged 55 and older (and people with disabilities) with a joint income of less than $45,000 per year

Please note that the 411 Income Tax Clinic cannot file returns for people who have self-employment income, rental income, capital gains, or who are filing a tax return as part of a bankruptcy proceeding or for a deceased person.

Tax receipts (T4’s, T5’s, RRSP contributions, charitable donations, etc.) will be mailed to you at the end of February. If you received a provincial government benefit in the previous year (Prov. Seniors’ Supplement, SAFER, Bus Pass, etc…) valued at more than $500, you will be issued a T5007 Tax Receipt by the government agency (Ministry of Social Development or BC Housing) that provided the benefit. These T5007s are in addition to the T5 that you will receive from the federal government for your CPP, OAS and GIS benefits.

411 Seniors’ Income Tax Clinic 2025

Our 2025 Income Tax Clinic is open from March 3, 2024 to April 24, 2025 from Monday to Thursday.

In March 2025, once you have received all of your T5s and any other tax receipts you are expecting, such as receipts for medical expenses of charitable donations, we ask that you kindly make an appointment (so that we may be wise in scheduling our volunteers/advisors). We can help you faster if you have all your tax related documents with you.

There are 3 ways to make an appointment:

- Drop into the centre and talk to us at the front desk

- Contact us by phone at 604-684-8171 ext. 3

- Email us at taxes@411seniors.org

We can not help you if you have: foreign assets, self-employed income,

a business, or investment income.